The Realtor’s Association of Hamilton-Burlington has just reported the stats for July 2017. This is now the third full month that has passed since the Ontario government announced its Fair Housing Plan back in April. It has been a very interesting 90 days — and, of course, there’s been a lot of negative news coverage since, mostly related to the GTA.

Hamilton Remains a Strong and Unique Real Estate Market

Real estate is local. Hamilton is a world away from the rest of the GTA as far as real estate is concerned, though it may be impacted by the same external pressures. It’s best that we, when discussing real estate, speak in Hamilton real estate market terms and use Hamilton’s real estate market stats.

Listings Are Down, But Prices Still Up

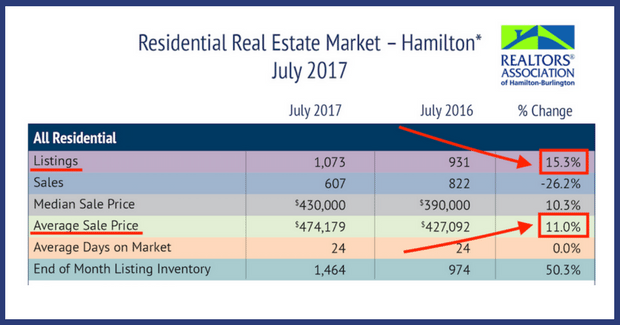

As of July, there were 1,073 new residential listings. This does not include commercial real estate. This number is up 15.3 percent versus July of 2016 when 931 homes were listed. This represents a much lower increase than we saw in either May or June.

In May, toward the end of the month, we had a large influx of listings as people became frightened by the recent changes announced by the government. We saw a 41 percent increase in new listings in May of 2017 over May of 2016 due to that fear. In June we saw that the new listings increased year over year by 20.1 percent, which was down significantly from May. Based on these numbers it appears as though the shock from Aprils announcement is already wearing off.

Ontario’s Fair Housing Plan did nothing to impact the price of homes. In fact, it didn’t really change anything — economists, real estate experts, and investors with knowledge of the market all agree that those 16 housing measures had little impact. Instead, it was a psychological tool. We saw a ton of fear in May, in June it dropped off, and in July it has continued to disappear.

Sales Numbers Are Down, But Properties Are Still Selling Fast

Sales were down to 607 in July of 2017 — down 26.2 percent from 822 sales in July of 2016. Give or take a few points, this is about on par with where we’ve been during the last 30 to 60 days. Sales generally go down when there’s both a dramatic rise of inventory and any amount of fear in the market. To clairfy, sales are down — not prices — and on average, this is still a large number of sales.

In comparison to the Greater Toronto Area, Hamilton is fairing very well. In the GTA, sales are down by 40 on average. York region and some of the surrounding communities are down as much as 40 to 70 percent in sales. So Hamilton is proving again to be fairly resilient.

The median sales price was $430,000 versus $390,000 in July 2016, up 10.3 percent. Average sales prices were $474,179 in July of 2017 versus $427,092 in July 2016, an increase of 11 percent. That’s a very strong number. Historically, average sale price increases of this number would be considered very high for year-over-year appreciation. Breaking the numbers down by housing type show that condos saw the greatest gain in average sale price for the month at 25.6%.

Average days on the market were identical at 24, with sales occurring just as fast as the prior year. Last year in July, the market was phenomenal, and at that time, record-breaking levels of activity were occurring. Homes are selling just as quickly in July of 2017.

The end of month inventory was 1,464 units on the market, which is a 54 percent increase from 974 in July 2016. So, of course, that large increase in inventory is why we’re seeing things sitting on the market a little longer than they were a few months ago. We are additionally seeing fewer multiple offers as buyers have more choice, although competition is still taking place on a daily basis and has appeared to pick-up in the final days of July.

Some Mitigating Factors Regarding Slower Sales and Pricing

One thing to point out is that the higher end of the market is being impacted the most. More affordable homes are still active and strong, and values are holding up and increasing. The higher priced product is most responsible for the month over month softening in average sale prices.

Prices are also impacted month to month by seasonal adjustments. In the summer, prices generally go down. Some of the numbers that are being reported in the news are really misleading as month over month average sale prices are affected by seasonal changes in the market. Of course, there’s been some softening, especially in the GTA in the last 90 days. But this is really being multiplied by the season. Even if the Fair Housing Plan hadn’t come out, we would still see a fluctuation in average sales prices — especially during these quieter times.

The Real Estate Market Appears To Be Recovering From Unfounded Fears

Our team experienced a dramatically different month in July versus June. Our busiest month ever was in July of 2017. We felt activity picking up and showings increasing, with less, but more serious buyers. Properties that were priced correctly were getting offers, with some listings selling in a couple of days and others within the first week. We were also seeing prices very close to or right on asking. We did have some listings sell for more than asking, and as the month progressed, we felt the positive effects of less inventory coming onto the market.

July was a very different month than June, in a very positive way. If things continue on this path we anticipate a strong fall market as kids get back to school and the announcements made in April become a distant memory.