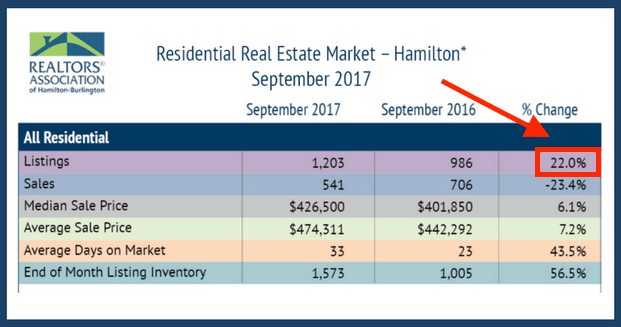

The Realtor’s Association of Hamilton-Burlington has just reported its sales stats for the month of September 2017. It’s now the fifth month since Ontario’s Fair Housing Plan was announced in April — and it was a record month for new listings in the Hamilton-Burlington area. This is in contrast to last month where we saw listings decline for the first time since April. Inventory appeared to be tightening over the course of the last few months as fears related to April’s annoucements wore off.

Anxious Sellers Jump Into Fall Market

We anticipated a spike in listing inventory for September, being that over the last four or five months, sellers were likely holding off in hopes that the climate would improve after April’s announcements.

Many people who got caught right in the shift were not achieving the types of sales that they were hoping to achieve. In many cases, these sellers took their homes off the market in hopes of waiting until things picked up, at which point they could relist and obtain a more favorable offer in a shorter amount of time. It looks like that pent-up supply has hit the market, and so we had a record number of new listings for September.

As a result, sales are down 23.4% — of course, with 22% more inventory on the market, this is expected. There’s more inventory to choose from, which generally results in fewer sales. Prices are up 7.2%, not as high as the almost 13% we saw last month, but still pretty solid. And, of course, with the inventory again hitting in such a big way and in such a short amount of time, it’s normal to see average sale prices decrease a little. We’ve been hovering somewhere in that 11% to 13% range in the last few months as inventory tightened, but with this increase in inventory, it’s not a shock. And remember, average sales prices are just a gauge; a market can’t be judged on average sale price alone, especially on a month-to-month basis. Average days on the market are now 33, up from last September. So homes are spending more time on the market but still moving well.

A Balanced Market for Buyers and Sellers

We’re sitting right now at about a 44% new listing-to-sale ratio. We aren’t a seller’s market, we aren’t a buyer’s market; we’re sort of teetering in the balanced territory.

For sellers; your house is not going to sell as quickly as it would five or six months ago, but we’re still getting solid gains, year over year. Gains in the 7% to 13% range above last year’s numbers are still very good. After average sale prices peaked at 24.8% in May, it’s easy to understand why some feel the market is slower than it actually is. In any other year, these gains would be great.

For buyers, it’s a great time. You have a lot more options with this increased inventory. For the past few years, buyers have struggled to find what they want because there was no inventory. Now there’s a selection, and not every home is selling overnight. 20% to 30% of homes in September, from our estimates, are still getting multiple offers and have competition — but that’s a far cry from the virtually 100% we were seeing back in May. Buyers now have better market conditions and have more time to make a decision with lessened competition.

Market Fundamentals Remain Strong

Prices have not dropped year over year. Those who are waiting for that to occur are likely going to be disappointed. The market is moving steady with all important fundamentals remaining intact. There’s no reason for the real estate market not to be moving forward. The economy, of course, is moving faster than we’ve seen in well over a decade. Interest rates have gone up twice in the last few months, but they remain among the lowest we’ve ever seen in history at 1%.

The Hamilton economy is doing very well. Hamilton’s wage growth currently ranks higher than almost any city in Canada. We’re seeing a lot of development activity, and overall everything is in place for the market to remain strong. With so many incredible things on the way for Hamilton, It’s hard to invision a scenario where growth in our market does not remain strong.

Buyers Should Act Now to Get Into the Market

Now is a great time to get into the market. If prices were going to decline year over year, it would have already occurred. We’ve seen things hold steady at strong average sale price levels, well above last year’s numbers.

The Toronto market is now stabilizing, and we’re seeing inventory beginning to tighten. The downtown is on fire. A condo in Toronto right now is looking at 10 to 20 offers and going well over asking. We’re going to see this trickling out into the outside areas of Toronto and into the suburbs in due time. In less than 12 months Vancouvers market regained it’s momentum and is now reaching new record highs. We followed their footsteps with the “fair housing plan” and we appear to be experiancing almost the exact same cycle as a result.

With interest rates starting to go up now, the bank has made it clear that they’re going to start moving rates up to ‘normal’ levels over the next few years. Again, the rates we’ve experienced up to this point are not normal. Rates should not be at 1%. Buyers need to take advantage of the balanced market that we’re seeing ahead of further rate increases, which could take place as early as this month. This is in addition to proposed mortgage rule changes, which could shave up to 20% off the average buyers budget mean buyers should act now.I’ll have a full breakdown regarding these potential changes over the next week.

For sellers, there’s no reason to panic. The market is steady. The majority of our listings are selling in a reasonable time and for fair market value. Things are not as crazy as they were back in the spring, and they may not return to those levels. But things are healthy. If you’ve been thinking about getting out of the market, it’s a great time to cash out and enjoy all of the equity you have gained. If not, there’s no reason to worry. Hold tight, enjoy your home, and know that we’re in the best place in the country for investment right now.

This period of balance may be shortlived depending on what happens with these proposed mortgage rules and interest rates. If rates rise another 2-3 times and new mortgage rules come into effect, prices will continue to grow but likely won’t return to the spring’s “red hot” levels that Vancouver is now experiancing again. If those changes don’t take place or don’t take place quick enough we could see the market heat up to pre-housing plan growth rates. If I had to bet right now I would say that our financial institutions will likely attempt to get ahead of this and adjust monetary policy to keep the market growing but not allow it to get out of control again. All of this will depend on how well our economy performs.

We’ll see what happens in October with Thanksgiving now behind us, I expect that the fall market will get into full swing. The bank of Canada will hold it’s next rate meeting on October 25th and OFFSI should be making it’s final decision on it’s proposed mortgage rule changes towards the end of the month. Our team had our best September in history. We sold twice as many homes as our last record September. Things have been very busy, lets see how October goes.